All about Custom Private Equity Asset Managers

Wiki Article

The 5-Minute Rule for Custom Private Equity Asset Managers

(PE): investing in companies that are not openly traded. About $11 (https://custom-private-equity-asset-managers.webflow.io/). There might be a few things you don't comprehend about the industry.

Companions at PE firms elevate funds and handle the cash to yield beneficial returns for shareholders, normally with an investment horizon of in between 4 and seven years. Personal equity firms have a variety of financial investment preferences. Some are rigorous financiers or passive investors entirely depending on management to expand the company and produce returns.

Since the very best gravitate towards the larger offers, the middle market is a considerably underserved market. There are a lot more vendors than there are very experienced and well-positioned finance specialists with substantial buyer networks and sources to handle an offer. The returns of private equity are commonly seen after a few years.

A Biased View of Custom Private Equity Asset Managers

Flying listed below the radar of large international firms, several of these little business commonly supply higher-quality client solution and/or specific niche products and solutions that are not being offered by the large conglomerates (http://go.bubbl.us/ddd0a6/87fd?/New-Mind-Map). Such upsides attract the passion of private equity firms, as they possess the insights and wise to exploit such possibilities and take the business to the next level

Private equity financiers have to have reputable, capable, and trustworthy management in location. Most managers at portfolio business are given equity and reward settlement frameworks that compensate them for hitting their monetary targets. Such positioning of objectives is normally called for prior to an offer obtains done. Exclusive equity possibilities are frequently out of reach for individuals who can not spend millions of dollars, but they shouldn't be.

There are laws, such as limits on the aggregate amount of money and on the number of non-accredited investors (Asset Management Group in Texas).

Custom Private Equity Asset Managers for Dummies

An additional drawback is the lack of liquidity; as soon as in a personal equity deal, it is not simple to obtain out of or offer. There is an absence of flexibility. Personal equity additionally includes high fees. With funds under administration currently in the trillions, private equity companies have actually come to be eye-catching investment automobiles for wealthy people and organizations.

Currently that access to exclusive equity is opening up to even more private financiers, the untapped capacity is coming to be a truth. We'll start with the main disagreements for spending in exclusive equity: Just how and why exclusive equity returns have historically been higher than various other properties on a number of degrees, Just how consisting of private equity in a profile influences the risk-return account, by helping to expand against market and intermittent risk, Then, we will describe some vital considerations and dangers for exclusive equity capitalists.

When it pertains to introducing a brand-new possession right into a portfolio, one of the most basic factor to consider is the risk-return account of that asset. Historically, exclusive equity has displayed returns similar to that of Arising Market Equities and higher than all various other traditional property classes. Its relatively low volatility combined with its high returns produces an engaging risk-return profile.

Our Custom Private Equity Asset Managers Ideas

weblinkIn fact, private equity fund quartiles have the widest variety of returns throughout all alternate asset courses - as you can see listed below. Approach: Internal price of return (IRR) spreads computed for funds within vintage years independently and after that averaged out. Average IRR was determined bytaking the standard of the average IRR for funds within each vintage year.

The takeaway is that fund selection is critical. At Moonfare, we lug out a stringent selection and due diligence procedure for all funds noted on the system. The effect of including private equity right into a portfolio is - as constantly - depending on the portfolio itself. A Pantheon research from 2015 recommended that consisting of private equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the very best exclusive equity firms have accessibility to an also larger swimming pool of unknown chances that do not encounter the same scrutiny, as well as the resources to do due persistance on them and recognize which deserve buying (Private Equity Firm in Texas). Spending at the ground flooring indicates greater danger, but also for the firms that do prosper, the fund gain from greater returns

Some Ideas on Custom Private Equity Asset Managers You Should Know

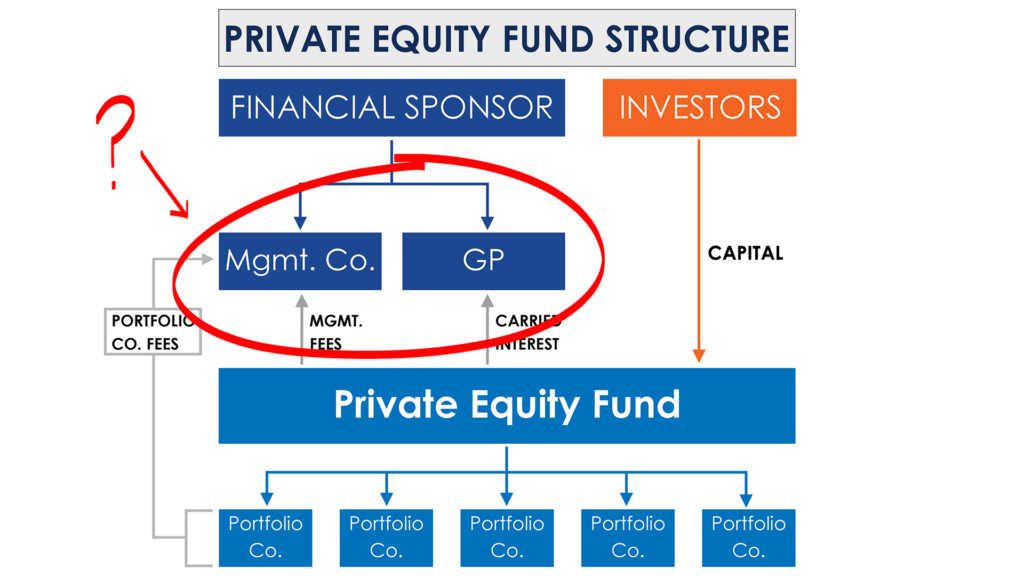

Both public and private equity fund managers commit to spending a portion of the fund however there stays a well-trodden concern with lining up interests for public equity fund monitoring: the 'principal-agent issue'. When a capitalist (the 'major') works with a public fund supervisor to take control of their funding (as an 'representative') they entrust control to the supervisor while retaining possession of the possessions.

In the case of private equity, the General Partner does not just gain a monitoring cost. Personal equity funds likewise reduce an additional form of principal-agent issue.

A public equity investor inevitably wants something - for the management to increase the stock cost and/or pay out dividends. The financier has little to no control over the decision. We showed above how several personal equity methods - especially majority acquistions - take control of the operating of the firm, guaranteeing that the lasting worth of the firm comes first, rising the roi over the life of the fund.

Report this wiki page